Loading

Our Services

Worldwide IT & Fintech Tailored Solutions

Fintech Platform Development

- Digital banking infrastructure

- Multi-currency payment systems

- API integrations

- Scalable architecture

- End-to-end solutions

AI & Data-Driven Solutions

- Predictive analytics

- Fraud prevention

- AI-powered automation

- Behavioral insights

- Smart decision-making tools

Cybersecurity & Compliance

- AML & KYC frameworks

- Regulatory compliance

- Multi-layer security

- Data protection

- Continuous monitoring

Custom IT Solutions

- Enterprise software

- Cloud-based platforms

- Process optimization

- Dedicated developer teams

- 24/7 technical support

Who We Are

Your Trusted Partner for Global Insurance Solutions

Decades of Experience & Innovation

Deliver Exceptional Service Worldwide

Decades of Proven Industry Expertise

Case Studies

Real-World Solutions in Action

Discover how we help clients overcome complex insurance challenges. From strategic planning to claims management, our solutions are tailored to drive efficiency, minimize risks, and secure long-term success.

Show More

Why Choose Us

The Right Partner for Your Insurance & Investments

For over three decades, our company has built a reputation for trust, innovation, and client-first solutions. We focus on delivering value by combining expertise, technology, and personalized strategies designed to protect and grow your assets.

Greater Benefits

Maximize coverage and investment outcomes while keeping costs under control.

Insurance

Management

Strategic

Investments

Strong Value Proposition

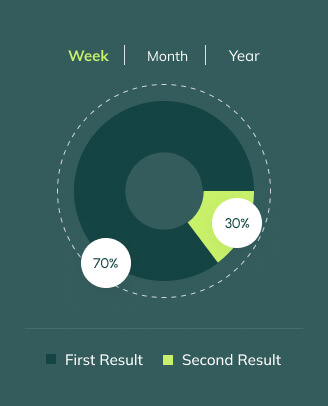

Efficient launch · Scalable revenuesWhy Invest With Us

Investor Highlights & Common Questions

-

What differentiates your platform from other fintechs?A proprietary, modular banking stack (accounts, cards, payments, FX) plus deep compliance tooling enables faster launches, lower costs, and quicker product iteration than typical vendor-dependent builds.

-

How do you manage risk, KYC/AML, and regulatory compliance?Compliance-by-design: automated KYC/AML workflows, rule engines for fraud monitoring, audit trails, and reporting. Policies align to EU requirements and partner-bank standards to support scalable, cross-border growth.

-

What is the business model and main revenue streams?Interchange and card fees, FX spread, subscription accounts, payment gateway processing, and B2B services (APIs, treasury, payouts). Diversification reduces dependency on any single line of revenue.

-

Why is your cost structure attractive to investors?A mature codebase and experienced in-house team compress launch timelines and vendor spend—translating into lower burn, faster payback periods, and better unit economics from the start.

-

What’s the go-to-market and expansion roadmap?Phase 1: EU launch with core banking features. Phase 2: product depth (credit, advanced FX, B2B pay-ins/payouts). Phase 3: expansion to high-remittance corridors and SME hubs with local partners.

-

What are the exit scenarios and target timelines?Multiple paths: strategic acquisition by a bank/PSP, equity buyback once profitability is durable, or public listing when scale and metrics align.

Highlights

What You Get with

Our Platform

Security & Compliance

Built to Be Trusted

KYC/AML by Design

Automated identity verification with sanctions and PEP screening is built into onboarding and account changes. Continuous monitoring, configurable risk rules, and a case management console streamline reviews while maintaining consistent outcomes and audit-ready records for regulators and internal teams.

Strong Customer Authentication (PSD2)

Risk-based authentication enforces device binding and step-up challenges for sensitive actions. Support for OTP, biometrics, and 3-D Secure balances friction with security, improves approval rates, and keeps payments compliant with PSD2 while protecting customers and businesses from account takeover and fraud.

Data Protection & Audit Trail

End-to-end encryption in transit and at rest, tokenization of sensitive fields, and least-privilege access safeguard data across services. Immutable audit logs with granular reporting deliver full traceability for regulators and simplify investigations, monitoring, and internal compliance reviews at scale.

Our Contact

let's work together

Please reach us via WhatsApp or email — we usually reply within one business day.

-

Call For Inquiry

+1 940 623 3442

-

Send Us Email

info@berentix.com

Get in Touch Now

Choose your preferred channel below. We’re here to help with partnerships, onboarding, and support.

Prefer calling? Reach us at +1 940 623 3442.